3 Dividend-Paying Tech Stocks to Buy Right Now

Many companies reduced or suspended their dividends as they faced intense challenges during the COVID-19 pandemic. Yet many companies in the tech sector, which was better-insulated from the outbreak than other industries, sustained their payouts without issue.

Last month, I highlighted three dividend-paying tech stocks that were still worth buying: TSMC, IBM, and Broadcom. Today, I'll add three more companies to that list.

Image source: Getty Images.

1. Texas Instruments

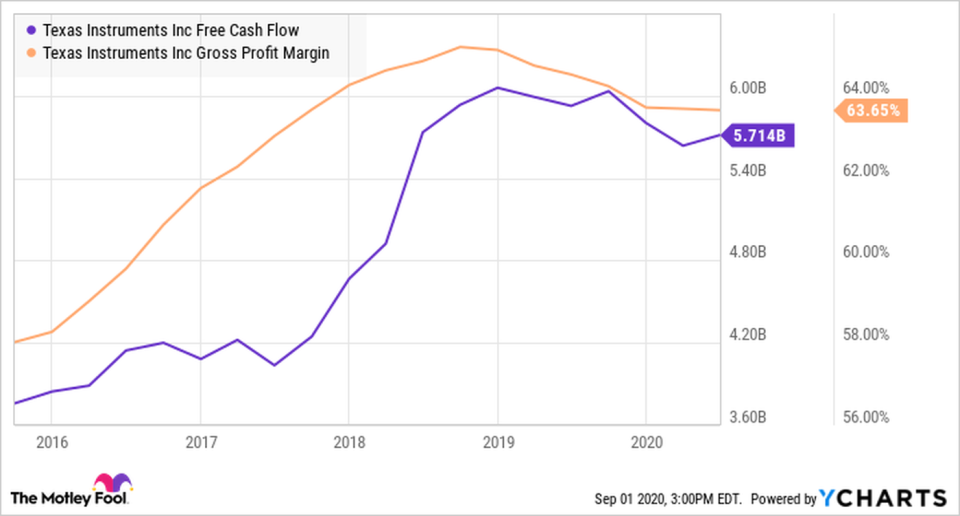

Texas Instruments (NASDAQ: TXN) sells analog and embedded chips to a wide range of industries. Over the past few years, it cut its production costs up to 40% by shifting from 200mm to 300mm wafers, which significantly boosted its gross margin and free cash flow.

Data by YCharts.

TI aims to return all of its FCF to investors via buybacks and dividends. The company has reduced its share count by over 45% since 2004 and raised its dividend annually for 16 straight years. It pays a forward dividend yield of 2.5% as of this writing, spending about 56% of its free cash flow on those payments over the past 12 months.

Revenue fell 9% in 2019 due to uneven chip sales to the macro-sensitive auto, industrial, communications infrastructure, and personal electronics sectors, and its earnings dropped 6%. Analysts expect revenue and earnings to decline another 7% and 3%, respectively, this year, as it grapples with the shutdowns of auto plants throughout the COVID-19 crisis.

That outlook seems grim, but Texas Instruments has weathered plenty of downturns in the past. Its year-to-date rally of about 13% also suggests investors are already looking past these near-term headwinds and focusing on its shareholder returns. Its stock may not seem cheap at nearly 30 times forward earnings, but its P/E ratio should cool off as its earnings stabilize, and the company continues to repurchase shares.

2. Cisco Systems

Cisco (NASDAQ: CSCO) is the world's largest manufacturer of networking switches and routers. It also bundles various software services, including security and collaboration platforms, with its hardware products.

Image source: Getty Images.

Revenue fell 5% in fiscal 2020, which ended in late July, as macro headwinds throttled sales of its hardware products to enterprise and data center customers. However, buybacks lifted its adjusted earnings 4% for the year.

The company's troubles will likely persist through fiscal 2021 due to COVID-19, a trade war, and other macro headwinds, and analysts expect its revenue and earnings to decline 2% and 4%, respectively, during the year. Those growth rates are anemic, but Cisco's low forward P/E ratio of 15 indicates that plenty of pessimism is already baked into the stock.

On the bright side, Cisco's security and Webex collaboration businesses are still growing, it's generating a higher mix of its revenue from software and services, and its gross margin remains stable. It also pays a generous forward dividend of 3.4%, and it has raised that payout annually for nearly a decade. It spent just 41% of its FCF on that dividend over the past 12 months, which leaves it with plenty of room for future hikes.

3. Seagate Technology

Seagate (NASDAQ: STX) is one of the world's largest manufacturers of platter-based HDDs (hard disk drives). Unlike its top rival Western Digital, which expanded into the higher-growth SSD (solid state drive) market, Seagate focused on developing cheaper and higher-capacity HDDs for enterprise and data center customers.

The company was riding a cyclical rebound in the data storage market before the COVID-19 crisis derailed that recovery. Specifically, declining HDD sales to the video and image application, mission-critical, and consumer markets offset its robust sales to the cloud and data center markets.

Seagate's revenue was up just 1% in fiscal 2020, which ended in early July, while adjusted EPS fell 4%. Like the other companies on this list, Wall Street expects that pain to continue this year, reducing its revenue and earnings 5% and 8%, respectively.

But like Texas Instruments and Cisco, Seagate has weathered plenty of downturns before, and its cyclical recovery should resume after the pandemic passes. Until then, investors can collect a dividend that yields 5.4% as of this writing, and its low forward P/E ratio of 10 should set a firm floor under the stock. Seagate raised its dividend for the first time in four years last November. It spent just 60% of its FCF on that payout over the past 12 months, so it could reward patient investors with another dividend hike later this year.

More From The Motley Fool

Leo Sun owns shares of Cisco Systems. The Motley Fool owns shares of and recommends Taiwan Semiconductor Manufacturing. The Motley Fool owns shares of Texas Instruments. The Motley Fool recommends Broadcom Ltd. The Motley Fool has a disclosure policy.

3 Dividend-Paying Tech Stocks to Buy Right Now was originally published by The Motley Fool

Yahoo Sport

Yahoo Sport