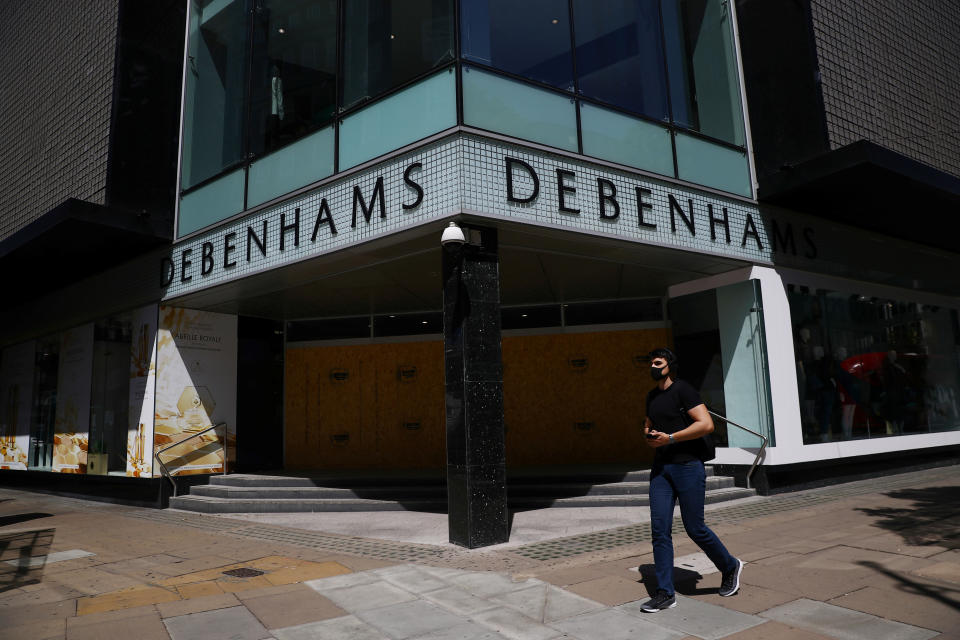

Sports Direct tycoon Mike Ashley ups Debenhams offer

Sports Direct tycoon Mick Ashley has redoubled his efforts to take control of Debenhams, improving his offer in an auction for the beleaguered department store.

The auction, run by Lazard, is nearing its end, with Ashley pursuing the chain which fell into administration for the second time in April, according to reports in The Sunday Times.

The move could help to save Debenhams, which employs around 12,000 and has more than 120 UK sites.

Lazard was appointed in July to conduct the sales process and had asked potential buyers to submit offers by the start of September.

In September, India’s Richest man, Mukesh Ambani was said to be in the running to make a bid, but has since reportedly dropped out

Current owners, including hedge funds Silver Point and Golden tree, recently moved to decide the business’s fate, lining up Hilco as a liquidator.

Ashley has previously owned almost 30% of Debenhams, losing close to £150m ($116.1m) when it was taken over by lenders last year.

READ MORE: Coronavirus pushes 11,120 UK shops to close

In March last year, Sports Direct said that it was considering making an offer of 5p per share for Debenhams, which would value the retailer at £61.4m. This was before it went into administration and was delisted from the stock market.

At the time, the bid included the promise that Sports Direct would help Debenhams with its funding requirements but only if Sports Direct founder Mike Ashley were installed as CEO of the department store.

Debenhams is among scores of other retailers facing an uncertain future due to the pandemic.

The first half of the year has seen a record number of store closures in the UK.

According to research by the Local Data Company (LDC) and PwC UK, 11,120 chain operator outlets have shut so far this year, while 5,119 shops opened. This means a net decline of 6,001 — almost double the decline tracked in 2019.

That count could be higher still, as researchers did not take into account shops which have yet to reopen following the COVID-19 lockdown, with the grim expectation that many will never operate again.

Watch: Why job losses have risen despite the economy reopening

Yahoo Sport

Yahoo Sport