FTSE 100 Live: Halifax house prices fall; former Diageo boss dies; Telegraph up for sale

China today revealed a bigger-than-expected export slump in another sign of slowing global economic activity.

The 7.5% decline year-on-year in May helped to fuel investor caution, with the FTSE 100 index trading lower this morning.

More evidence of the slowing UK economy emerged when Halifax reported the first year-on-year decline in house prices since 2012.

FTSE 100 Live Wednesday

Zara owner beats profit forecasts

Diageo CEO Sir Ivan Menezes dies

Shares surge at William Hill owner 888

Key market data as FTSE closes flat

16:54 , Daniel O'Boyle

The FTSE 100 closed flat at 7,624.34 today, as late-morning gains disappeared following the Bank of Canada’s surprise decision to raise interest rates.

Click through the tabs to see all the graphs

Receivers kick Barclays off board as they put Telegraph and Spectator up for sale

16:09 , Daniel O'Boyle

Receivers confirmed that Lloyds bank has put the Telegraph and Spectator up for sale, kicking David Barclay’s sons Aidan and Howard off the board of the newspaper.Alastair Beveridge and Ben Browne of AlixPartners were appointed by Lloyds as receivers as the bank aims to recover loans racked up by the business.According to the Times, which first revealed Lloyds’ plans to put the Telegraph into receivership, the newspaper could fetch a £600 million price tag.

Bank of Canada raises rates

15:10 , Daniel O'Boyle

The Bank of Canada unexpectedly raised its interest rate by 25 basis points to 4.75%, joining the Reserve Bank of Australia in raising rates this week.

Investors had expected the bank to hold rates at 4.5%, with inflation at 4.4%. However, like Australia’s central bank, Canada’s surprised the market with a rate hike.

US shares in bull market after early gains

14:59 , Daniel O'Boyle

Wall Street shares are in a bull market, with the S&P 500 having gained more than 20% since its October trough, with Netflix leading the way.

Click through the tabs to see all the US market data.

Fridays owner Hostmore reveals sales dip as cost-cutting plan continues

14:39 , Daniel O'Boyle

The parent firm of restaurant chain Fridays has revealed a slight dip in sales so far this year as customer spending continues to come under pressure.

Hostmore told shareholders on Wednesday that total revenues dipped 1% over the 22 weeks to June 4, over the same period last year. Meanwhile, like-for-like sales were down 3%.

The group runs 91 sites across the Fridays – which recently rebranded from TGI Fridays – and 63rd+1st brands.

Chelsea landlord Cadogan toasts growth as CEO calls for rethink on ‘tourist tax’

13:56 , Daniel O'Boyle

Cadogan, one of central London’s oldest landlords, has revealed a buoyant retail property performance but its chief executive warned the government should rethink the ‘tourist tax’ before it causes “irreversible damage” to the capital.

Hugh Seaborn joins a growing number of business leaders that want to see duty-free shopping reinstated. It was axed in 2021 and had made purchases in the UK 20% cheaper for international visitors.

The latest comments came as Chelsea and Knightsbridge landlord Cadogan published results that show the value of its property portfolio, comprising shops, restaurants, flats and offices, climbed 5.4% in 2022 to £5.1 billion.

FTSE gains ground

13:01 , Daniel O'Boyle

The FTSE 100 entered positive territory just before lunchtime today.

Click through the graphs to see all the key market data.

City Comment: Raise a glass to Ivan Menezes, a captain of industry

12:10 , Jonathan Prynn

It had been clear that the news about Sir Ivan Menezes was unlikely to be good following Diageo’s announcement on Monday that he had suffered complications during surgery for a stomach ulcer. It was nevertheless shocking to learn this morning that he has died aged only 63.

At a time when the business leadership of this country is in the news for all the wrong reasons, it is worth reflecting that Britain is still blessed with some world class captains of industry — as they used to be known.

Sir Ivan was one of them.

City banks race to hire AI experts in their thousands

11:23 , Simon Hunt

AI recruitment has surged among Britain’s biggest banks as they jostle to attract top talent to thousands of new roles.

Barclays bank hired as many as 1,374 staff in AI roles between February and April, according to data from insights business Evident, while 30% of job descriptions for NatWest’s hires were AI-related.

The 60 largest North American and European banks now employ around 46,000 people in AI development, data engineering and governance and ethics roles, with as many as 100,000 global banking roles involved in bringing AI to market. Some 40% of AI staff within these banks have started their current roles since January 2022.

But there are also fears the UK’s banks could be falling behind their US counterparts, with American giant JPMorgan hiring twice as many AI-related jobs as any of its rivals.

UK economy still lagging behind other nations despite upgraded forecast

11:02 , Daniel O'Boyle

The UK economy will continue to lag behind other countries in the group of seven (G7) advanced economies this year, despite improved growth projections, new analysis has shown.

Only Germany, which fell into a recession over the start of the year and is set to stagnate throughout 2023, will perform worse than the UK.

Analysis from the Organisation for Economic Co-operation and Development (OECD) forecast that the UK’s economy will just about eke out growth this year.

Harbour Energy and M&S lead FTSE 250, gambling firm 888 up another 19%

10:18 , Graeme Evans

Speculation linking North Sea oil firm Harbour Energy to a US merger today fired up the company’s shares by 4%.

The former blue-chip, which also operates in Indonesia, Vietnam and Norway, is reported to have held talks over a tie-up with Texas-based Talos Energy.

Shares rose 10.4p to 250p, having fallen from October’s 450p after the Energy Profits Levy took its UK tax rate to 75% and all but extinguished 2022 profits. The company is reducing investment in the UK and warned of significant job losses.

Chairman Blair Thomas wrote in Harbour’s recent annual report: “The simple truth is that capital will go where it is welcome and avoid places that have onerous tax regimes or regulatory regimes that stifle the market.”

Should the merger happen, it could mean another stock leaving London after Reuters said the pair are considering a New York listing. Harbour, which is worth £2 billion, was created in 2021 through the combination of Chrysaor with Premier Oil.

Harbour was just ahead of Marks & Spencer in the FTSE 250, with the rejuvenated retailer up 6.45p to its highest since early 2022 at 194p.

The shares, which started 2023 at 125p, benefited from Zara owner Inditex reporting stronger-than-expected trading. The chain’s update also boosted Primark owner Associated British Foods, which surged 3% or 62.5p to 1902.5p.

Gains of 3% for Vodafone and BT shares also supported the top flight, which stood 2.72 points lower at 7625.38 as investors reviewed more global economic weakness after China’s below-par export figures.

The FTSE 250 index fell 34.26 to 19,182.96, despite electronics manufacturer discoverIE lifting 12p to 809p on annual results.

In the FTSE All-Share, 888 Holdings continues to gallop ahead after former Entain directors including ex-CEO Kenny Alexander built a 6.6% stake in the William Hill owner. Shares lifted another 19% or 15.15p to 95.15p, adding to yesterday’s 14% jump.

Diageo’s CEO Sir Ivan Menezes dies after complications from surgery

10:05 , Michael Hunter

Sir Ivan Menezes, the CEO of Diageo and one of the FTSE 100’s longest-serving leaders, has died after a brief illness, the company said today. He was 63.

He died days after emergency surgery for conditions including a stomach ulcer, which suffered complications. Born in July 1959 in Pune, India, and educated St. Stephen’s College in Delhi and the Indian Institute of Management in Ahmedabad, he was due to retire from the multinational he helped transform at the end of this month. He was married with two children.

Zara owner beats profit forecasts

09:27 , Daniel O'Boyle

Profits at Zara owner Inditex grew to a better-than-expected €2.2 billion (£1.9 billion) in the first three months of the year, as the retail fast fashion brand grows while online rivals struggle.

Sales hit €7.6 billion, thanks to “very satisfactory development both in stores and online”.

The results are a stark contrast from online-only fashion brands like Asos and Boohoo, where losses have piled up.

With cash reserves growing beyond €10 billion, Inditex is planning a major redesign of its stores.

Shares are up 5.3% to €33.52 today.

Key market data with FTSE flat

09:14 , Daniel O'Boyle

The FTSE 100 headed back towards yesterday’s closing level after an initial fall this morning.

Take a look at all of the key market data from the first hour of trading.

Adnams sounds alarm on challenging conditions

08:53 , Simon Hunt

The Chair of Adnams has sounded the alarm on the continued strain facing the family-run brewer and pub chain after losses for 2022 widened to £2.3 million.

Jonathan Adnams said: “We had looked forward to our markets returning to normal post pandemic. The start to the year promised this, then global events transpired and has led to the UK and the rest of the world facing many challenges from economic, social and environmental perspectives.

“It is no overstatement to suggest that, for the company and the wider brewing and hospitality sector, the business environment has been at least as challenging as during the Covid-19 pandemic.”

But Clive Watson, chair of City Pub Group which today reported sales growth of 20% in the first 23 weeks of 2023, told the Standard those concerns were overblown.

“I can see why he’s saying it but that’s not our experience,” he said.

“There’s a lot of doom and gloom out there [but] we have a heavy bias on London and I think London is particularly strong at the moment.”

FTSE 100 lower, M&S and other retail stocks higher

08:42 , Graeme Evans

London’s blue-chip index is trading in the red, with weaker housebuilding and mining stocks contributing to a fall of 9.77 points to 7618.33 for the FTSE 100.

Primark owner Associated British Foods is the best performing stock, lifting 45.5p to 1885.5p in a session when Next, Frasers Group and Tesco are also on the risers board.

The FTSE 250 index is 28.87 points lower at 19,188.35, but North Sea explorer Harbour Energy rose 4% or 10.3p to 249.9p on speculation over a potential merger with Gulf of Mexico-focused Talos Energy.

The buying of retail stocks also saw Marks & Spencer shares lift 2% or 3.55p to 191.15p, while electronics designer and manufacturer discoverIE lifted 12p to 809p on the back of its annual results.

England stars invest in Sixes Social Cricket ahead of US expansion

08:33 , Daniel O'Boyle

“Social cricket” hospitality chain Sixes has landed investment from England cricket stars Ben Stokes, Stuart Broad and Jofra Archer as it prepares to expand into the US.

4CAST investment group, which was founded by Stokes, Broad and Archer, will provide funding to help Sixes - a food and drink venue with batting nets and bowling machines for customers to test out their batting skills - expand.

888 shares jump another 20% as ex-Entain boss Alexander takes stake

08:20 , Daniel O'Boyle

Shares in William Hill owner 888 soared today as a group including former Entain boss Kenny Alexander revealed they had bought a stake in the betting giant.

FS Gaming Holding, which includes Alexander and former Entain chair Lee Feldman, revealed a 6.57% stake in 888 yesterday, making the case that its shares had been undervalued afetr a sharp fall this year amid regulatory scandals in the UK and the Middle East.

Alexander - who built the small business then known as GVC Holdings into the multi-billion pound owner of Ladbrokes - had kept his distance from the gambling sector since his shock exit from Entain in 2020. Days after his departure, HMRC announced it was widening the scope of an investigation into its former Turkish business and new boss Shay Segev set out a new strategy to ditch so-called “grey markets” where online betting isn’t regulated. Media reports in 2019 claimed Alexander had sold GVC’s Turkish operations to a friend as the group attempted to clean up its operations in order to buy Ladbrokes.

Investec analyst Roberta Ciacca said: “While there have been questions historically over his corporate governance track record… he is still behind the transformation of GVC from a minnow into the industry giant that Entain is now.”

888 shares are up 19.3% today and 32.6% since yesterday afternoon.

Last week, Entain revealed it expected a “substantial” penalty from the HMRC investigation.

DX Group settles corporate spying claim

07:51 , Michael Hunter

Delivery company DX Group has settled corporate espionage claims made against it by a competitor, ending a dispute that knocked its share price amid accusations that it confidential information.

The courier firm best know for moving documents between legal firms faced a claim in the High Court from Sheffield-based rival Tuffnells Parcels Express after newspaper reports said DX staff, formely employed by Tuffnells, obtained daily customer service reports.

DX said previously that “matters referred to in the claim were subject to a corporate governance inquiry” and an internal investigation and that it would “defend its position robustly”.

It said today: “This confidential settlement, which is without any admission of liability, brings the claim to a satisfactory conclusion for all parties. It has no impact on the Company’s expectations for its financial year ending 1 July 2023 or thereafter.”

China worries fuelled by exports miss, FTSE 100 seen flat

07:23 , Graeme Evans

More signs of China’s slower than expected recovery from Covid lockdowns will fuel investor caution today, with the FTSE 100 index expected to open broadly unchanged.

Exports from the world’s second largest economy reversed 7.5% year-on-year in May, the first decline since February and bigger than estimates for a decline of less than 2%.

Michael Hewson, chief market analyst at CMC Markets, said: “While the imports numbers were better than expected the plunge in exports into negative territory for the first time in three months is a real concern suggesting that while domestic demand is starting to turn higher, global demand is starting to falter, and that the Chinese government may need to do more to boost the local economy.”

Asian stock markets posted a mixed performance on the back of the release, with Tokyo’s Nikkei down 2% but the Hang Seng in Hong Kong still in positive territory.

US markets posted modest gains yesterday, aided by a strong session for the banking sector, as the index measuring volatility fell to its lowest level since the pandemic.

Defensive sectors boosted European markets on Tuesday, with the FTSE 100 and the FTSE 250 up 0.4% and 0.5% respectively.

CMC Markets expects London’s top flight to open eight points higher at 7636 this morning.

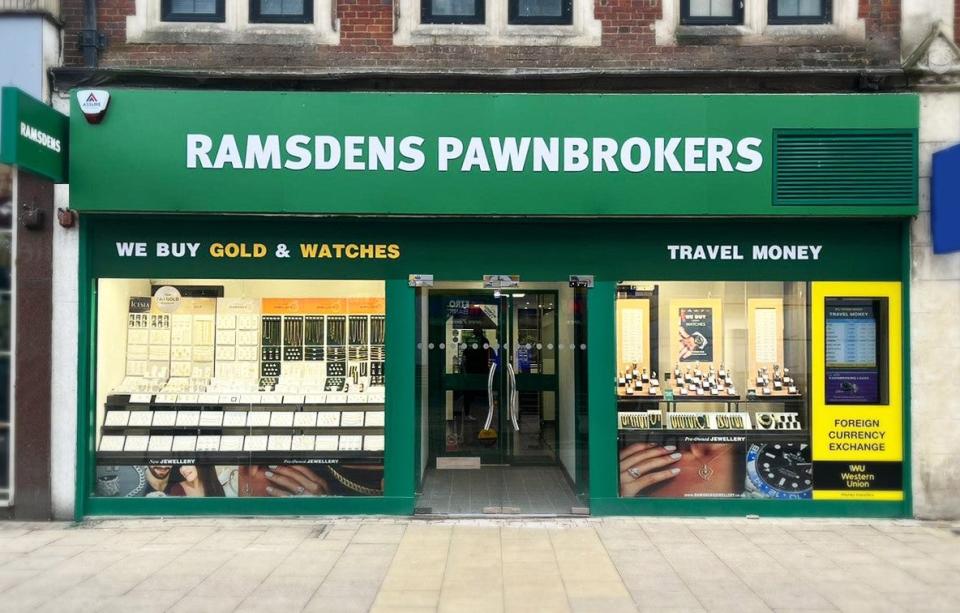

Sales jump 33% at Pawnbrokers Ramdens in signs of wider cost-of-living pressures

07:19 , Simon Hunt

Sales jumped 33% at Pawnbrokers Ramdens in the six months to the end of March in signs of wider cost-of-living pressures.

Pre-tax profits also surged 68% to £3.7 million, while the firm’s pawnbroking loan book at the Period end increased by 29% to £9.7m.

“With restrictions in the availability of other forms of small sum credit, and the continued squeeze on household incomes with higher bills, we believe that demand for small sum loans will continue to be high for the remainder of 2023,” Ramsdens said.

“The ease, simplicity and transparency of pawnbroking will continue to provide solutions for customers needing short term financial assistance provided they have assets to pledge.”

Halifax: House prices down year-on-year

07:05 , Daniel O'Boyle

House prices declined year-on-year for the first time since 2012 in May, according to Halifax’s House Price Index.

Prices were flat month-on-month with the average UK property now costing £286,532. But this was 1% below May of last year.

Kim Kinnaird, Director, Halifax Mortgages, said: “House prices were largely unchanged in May, edging down very slightly (-£130) compared to April, with the average UK property now costing £286,532. More notably the annual rate of growth fell to -1.0%, marking the first time since 2012 that house prices have fallen year-on-year. Given the effectively flat month, the annual decline largely reflects a comparison with strong house prices this time last year, as the market continued to be buoyant heading into the summer.

“Property prices have now fallen by about £3,000 over the last 12 months and are down around £7,500 from the peak in August. But prices are still £5,000 up since the end of last year, and £25,000 above the level of two years ago.

“As expected the brief upturn we saw in the housing market in the first quarter of this year has faded, with the impact of higher interest rates gradually feeding through to household budgets, and in particular those with fixed rate mortgage deals coming to an end.

The latest data comes as mortgage lenders, including Halifax, ramp up their mortgage rates.

Recap: Yesterday’s top stories

06:45 , Simon Hunt

Good morning. Here’s a summary of our top stories from yesterday:

Firms have backed the CBI despite widespread reports of misconduct, with 93% of members throwing their support behind the organisation in a vote.

The US securities regulator has sued Coinbase in the latest sign of its crypto crackdown.

A third of UK hospitality businesses do not think they will survive the next 12 months and 70% will increase prices in coming year says survey as Michel Roux Jr warns inflation is killing restaurants.

Property group Warehouse REIT made a £180 million loss after a spike in interest costs.

Yahoo Sport

Yahoo Sport