UK house prices at record high after biggest leap since 2016

UK property prices have hit a record high after their biggest monthly leap since 2016.

The average property sold for £245,747 ($325,000) in August, according to a widely-followed house price index released on Monday by lender Halifax.

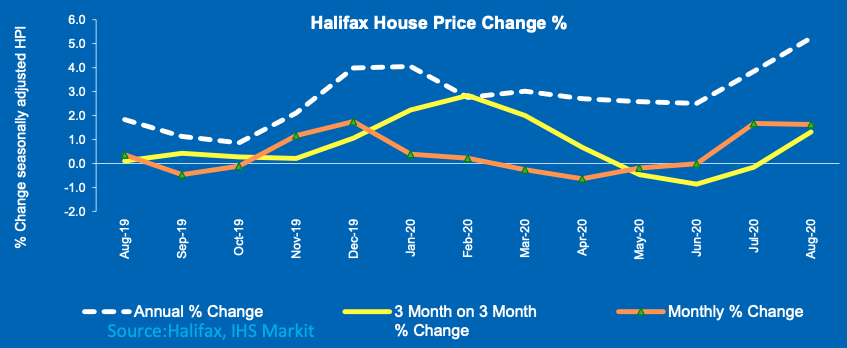

It marks a 1.6% increase on prices in July and 5.2% rise on a year earlier, the biggest monthly jump since late 2016. The price gains still came in below analysts' expectations however, with most expecting a 6% rise year-on-year.

Britain’s property market has seen sales and prices boom in recent months, with a surge in demand post-lockdown and a temporary stamp duty holiday driving growth.

READ MORE: Britain warned it’s heading towards a housing bubble

Separate figures by rival lender Nationwide last week showed prices at a new all-time high in August. Nationwide’s data showed prices rising 2% between July and August, and 3.7% year-on-year.

Bank of England data last week also showed lending for new mortgages soared by 66.2% between June and July. Lenders approved 66,300 mortgages for residential property purchases in July, according to a comprehensive survey by the central bank.

UK chancellor Rishi Sunak announced a temporary stamp duty holiday on purchases under £500,000 ($671,000) in England and Northern Ireland in early July. Estate agents say the measure “turbo-charged” a market already buoyed up by soaring interest in moving home after months of lockdown, as well as the completion of delayed transactions.

The growth of the market comes in spite of the pandemic, social distancing and wider economic crisis, which has seen millions of households hit by job loss, furlough or pay cuts. Leading forecasters expect Britain’s GDP to shrink by 10% this year.

READ MORE: HSBC limits 10% mortgages for first-time buyers

Many in the industry expect the property market’s growth to slow if not go into reverse later this year, as the furlough scheme and mortgage holidays are wound down and unemployment likely ticks higher. Most lenders have also begun tightening access to low-deposit mortgages, which could hit first-time buyer numbers.

Russell Galley, managing director of Halifax, said it was "highly unlikely" current price inflation would be sustained.

“Rising house prices contrast with the adverse impact of the pandemic on household earnings and with most economic commentators believing that unemployment will continue to rise, we do expect greater downward pressure on house prices in the medium-term,” he said.

Knight Frank, a property consultancy and estate and letting agent, said on Monday it did not expect price declines this year, however. It predicts prices will be "broadly flat" for the remainder of the year, and even rise in areas with more outdoor and green space.

It says most declines have been "priced in" already earlier this year, and the economy is also “more adaptable than assumed” with the end of the furlough scheme looming.

Yahoo Sport

Yahoo Sport