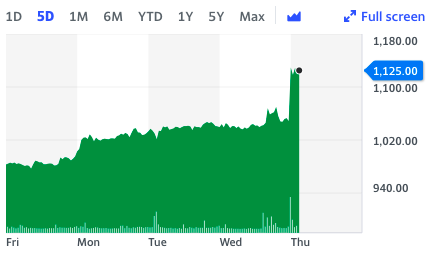

Ladbrokes owner's sales boosted by digital betting

Ladbrokes and Bwin owner, GVC Holdings (GVC.L), has raised its outlook for annual core earnings after posting a 12% rise in third quarter revenue, helped by the dramatic growth in online gaming and the restarting of major sporting events such as the English Premier League.

The company, which owns brands such as Coral and Eurobet, said full-year earnings before interest, taxes, depreciation, and amortization (EBITDA) is now expected between £770m ($917.91m) and £790m.

Previously, GVC had forecast annual earnings to be between £720m and £740m.

Online gaming volumes have resumed to pre-COVID-19 levels, the company said in a statement on Thursday, reflecting the “strength and diversity of our business model.”

“Like the rest of the UK and Europe’s high streets, GVC’s retail stores were forced to close in lockdown,” said Sophie Lund-Yates, equity analyst at Hargreaves Lansdown, in a note.

She added that “customers that became accustomed to gaming and digital wagering during lockdown have stuck around, and that’s a welcome development. Online activity can be more easily leveraged, meaning it tends to be better news for margins — once a website already exists, a new customer doesn’t really cost anything to service.”

Online net gaming revenue for the three months to 30 September jumped 26% as COVID-19 rules led customers to play more to relieve the pressures of the pandemic.

The business is also in expansion mode, announcing that it is moving forward with the acquisition of Bet.pt, an online gambling operator in Portugal. Gambling companies have been focusing on markets outside the UK as they face tighter regulations in Britain.

READ MORE: EasyJet set for first loss in history as CEO cries out for support

"While the risk of further restrictions as a result of COVID-19 mean that we remain cautious on the short-term outlook, in the longer term we are confident of being able to continue delivering sustainable growth for all our stakeholders," said Shay Segev, GVC's chief executive officer in the statement.

This includes its BetMGM business in the United States which has a market share of 17% in the country already, and he says it will continue growing “from strength to strength as we roll out into new states.”

The joint venture with BetMGM is on “tracking ahead of schedule — likely helped by its new official partnership with NASCAR,” said Lund-Yates.

“The US is a huge opportunity for GVC, it’s taking a punt that the easing of sports betting legalisation will open up fresh potential. GVC is going to have to keep digging though — it has a strong market position at the moment, but competition’s pretty fierce. With GVC shares trading some way above their ten year average, keeping hold of that lead is important if the share price is to be sustained.”

WATCH: Profits jump at Tesco, the UK's biggest supermarket

Yahoo Sport

Yahoo Sport