London financial services jobs bounce back from COVID-19 slump

Hope is on the horizon for London financial services jobs, as the number of positions available in the market picked up by more than 50% compared with the last quarter.

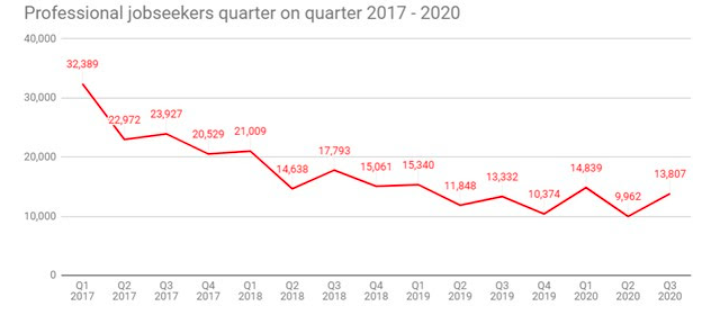

The 53% bump in new positions came alongside a 38% quarter-on-quarter increase in job seekers, according to data from professional services recruiter Morgan McKinley released on Monday.

Morgan McKinley’s Q3 Autumn London Employment Monitor details City hiring trends from July to September 2020.

Numbers from the previous quarter showed a massive drop off in job vacancies, which were down by 60% due to widespread COVID-19 lockdowns.

Morgan McKinley’s Autumn Employment Monitor also showed a 54% year-on-year decrease in jobs available in the capital.

Hakan Enver, managing director, Morgan McKinley UK said: “The good news is we’re seeing more companies finding a way of working through the pandemic and gaining an understanding of their recruitment needs. Banks are faring well and continue to hire.

“While vacancies are nowhere near the levels of a year ago, this is a positive sign that the Financial Services job market in London is headed in the right direction.”

Enver also said that businesses have no plans to roll back remote working, with some offering home-work as part of their compensation packages.

The dual impact of COVID-19 and a potential no-deal Brexit on the horizon has caused worry in the financial services sector.

READ MORE: Coronavirus pushes 11,120 UK shops to close

As the end of the government’s furlough scheme looms at the end of October Enver said that the “future still remains uncertain for many and professionals are understandably concerned about their prospects.”

“There are concerns for long term recovery and the free flow of capital and equivalence for UK financial services that needs to be clarified.”

The data is promising amid bleak projections elsewhere. Over the weekend, research was released showing the first half of this year saw a record number of store closures in the UK due to the coronavirus pandemic.

According to research by the Local Data Company (LDC) and PwC UK, 11,120 chain operator outlets have shut so far this year, while 5,119 shops opened. This means a net decline of 6,001 — almost double the decline tracked in 2019.

And that count could be higher, still as researchers did not take into account shops which have yet to reopen following the COVID-19 lockdown, with the grim expectation that many will never operate again.

Watch: Why job losses have risen despite the economy reopening

Yahoo Sport

Yahoo Sport