Rolls-Royce leads losses on FTSE over lockdown fears

Rolls-Royce (RR.L) is among the top laggards on the FTSE 100 (^FTSE) as COVID-19 fallout continues to roil markets in the UK.

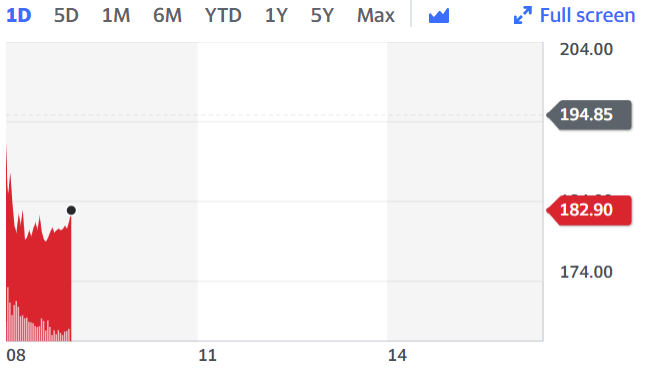

Shares were down as much as 7.5% in early trading in London on Tuesday.

“Another negative day for Rolls Royce after some impressive gains last week on the back of rising confidence that the fund raising seen in the past few weeks has given the company a buffer to ride out the current economic uncertainty,” said Michael Hewson, chief markets analyst at CMC Markets.

“The recent declines are a timely reminder that in the face of the prospect of further localised lockdowns, here in the UK and across Europe over the winter months, that the return of air travel on any meaningful basis still seems some way off.”

The struggling engine maker’s shares hit a 17-year-low earlier in October after the company announced plans to raise £5bn ($6.5bn) in debt and equity to shore up its balance sheet.

Rolls-Royce’s plans also include a highly discounted share issue. The funds will be used to repair the company’s balance sheet from the fallout following the COVID-19 pandemic.

READ MORE: Rolls-Royce shares hit 17-year low on £5bn fundraising plans

The business also plans to raise to raise up to £3bn in debt, including a new £1bn bond, has negotiated a new £1bn term loan, and has support from the government’s Export Finance to extend an existing five year loan by a further £1bn.

In announcing the news, leaders said the fundraising measures were necessary to reduce balance sheet leverage and improve liquidity. The additional cash would also help the business “weather macroeconomic risks.”

Recent news that the company was heading a nine-member consortium to build a string of Small Modular Reactor (SMR) power stations around the UK had helped the company’s share prices, but further lockdown fears have now weighed much more heavily.

Watch: What is a V-shaped economic recovery?

“It’s a classic case of buy the rumour, sell the fact really,” said Chris Beauchamp, chief market analyst at IG. “Although there’s not been much ‘fact’ to sell. Last week’s hope of support via a new package of smaller nuclear reactors that RR might build has faded, and with the prospects looking so dire it seems the hot money has gone from buying the shares on the cheap to selling the rally, essentially playing ‘whackamole’ with the stock after its best week in decades.”

“After a 150% trough-to-peak move the value trade is now much diminished, and the broader macro outlook which remains fundamentally unsupportive for the longer term has come back into play.”

READ MORE: Markets cautious as coronavirus vaccine trial delayed

UK Prime Minister Johnson unveiled on Monday a new tiered alert system for England, which would see different areas grouped into “Medium,” “High” and “Very High.”

Areas that are deemed to be under a Very High alert will see pubs and bars close, though shops and schools are expected to remain open.

The UK government also announced a sharp rise in cases on Monday, with 13,972 added to the growing national figure. The Scientific Advisory Group for Emergencies (Sage) has said it is "almost certain that the epidemic continues to grow exponentially across the country."

Watch: This mega yacht has a Rolls-Royce jet engine

Yahoo Sport

Yahoo Sport