Workiva's (NYSE:WK) growing losses don't faze investors as the stock ascends 5.1% this past week

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. One great example is Workiva Inc. (NYSE:WK) which saw its share price drive 260% higher over five years. Meanwhile the share price is 5.1% higher than it was a week ago.

Since the stock has added US$243m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Workiva

Given that Workiva didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Workiva saw its revenue grow at 19% per year. Even measured against other revenue-focussed companies, that's a good result. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 29% per year, in that time. So it seems likely that buyers have paid attention to the strong revenue growth. Workiva seems like a high growth stock - so growth investors might want to add it to their watchlist.

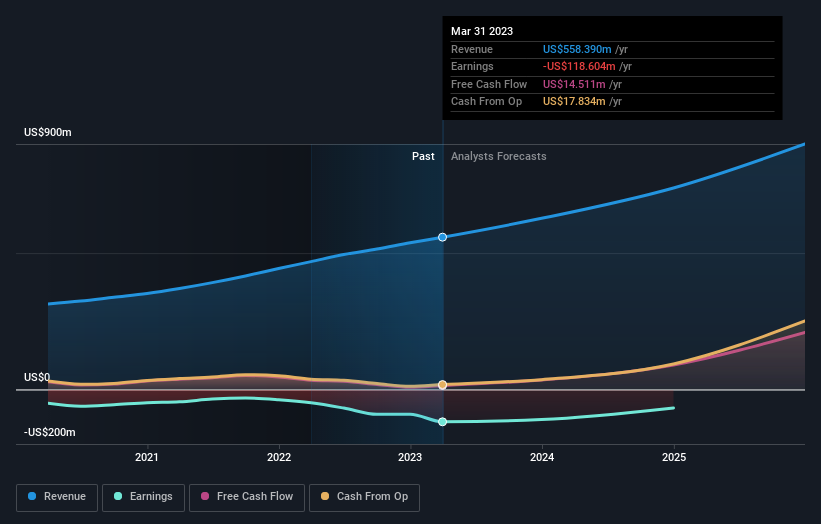

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Workiva is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Workiva stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

We're pleased to report that Workiva shareholders have received a total shareholder return of 28% over one year. However, that falls short of the 29% TSR per annum it has made for shareholders, each year, over five years. It's always interesting to track share price performance over the longer term. But to understand Workiva better, we need to consider many other factors. For example, we've discovered 3 warning signs for Workiva that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Sport

Yahoo Sport