Inside Newcastle United, LIV Golf and the next wave of Saudi spending

Saudi Arabia’s announcement that it plans to cut global spending by as much as 12 per cent immediately set alarm bells ringing across the sporting landscape.

The Gulf state’s Public Investment Fund (PIF) owns a majority share in Newcastle United and is also the founder of the LIV Golf League, the rebel series that divided the sport in two.

At the end of October, PIF announced plans to reduce its global investment, raising fears of a significant impact on its football and golf projects at a time when Newcastle are considering plans for a new stadium and as vital negotiations with the PGA Tour remain on the PIF agenda.

Saudi Arabia is also on course to host the 2034 football World Cup, with an announcement expected in December, which will require significant investment of its own.

But when the sovereign wealth fund is valued at £718.2 billion, one-fifth is still a sizeable expenditure. So are there reasons to be cheerful or concerned for those on Tyneside and the LIV circuit? This is what the future holds for both:

How did we get here?

The Saudi-led takeover of Newcastle in October 2021 is believed to have cost around £305 million, although PIF’s stake was limited to 80 per cent, with 10 per cent bought by the Reuben family and the remaining 10 per cent purchased by Amanda Staveley and her husband Mehrdad Ghodoussi. That meant PIF would have put in around £244 million to buy the club from former owner Mike Ashley.

Newcastle is now valued at anywhere between £550 million and £900 million, so the value of the asset has already doubled or possibly trebled in the three years that PIF has been the majority stakeholder.

On top of the initial outlay, PIF has regularly injected money into the club to help with cash flow, as well as fund the purchase of players, although the exact breakdown of the capital investment between the shareholders is not revealed in the club’s accounts. It is also not known how much it paid to buy out Staveley’s 10 per cent stake, alongside the Reuben family, though this should be revealed in the next set of accounts when the 2023-24 annual report is released in January.

Despite concerns about PIF’s commitment to long-term investment in overseas projects, Telegraph Sport understands it has put another £35 million into the club this month to go alongside regular injections of cash to help cover losses in each of the previous two years. Newcastle were allowed to lose £105 million over a three-year window, which ended last summer, under the Premier League’s profitability and sustainability rules (PSR). With their 80 per cent stake that would put PIF’s liability for these to around £84 million.

Newcastle have spent more than £430 million on players in the three years since the takeover, with only an estimated £110 million recouped through player sales. Not all of the money, though, has been provided by PIF with the club generating their own income, which has been spent on transfers.

That, however, pales in comparison to the LIV Golf balance sheets. LIV’s expenditure is approximately £2.5 billion as it heads towards its fourth season with very little return thus far. At least £1 billion has been spent on players’ contracts, plus more than £750 million in prize funds.

As well as staging events and building a huge backroom consisting of roughly 300 staff across four continents, with offices in New York, West Palm Beach, London and Saudi Arabia, the outlay has been extraordinary in forming what already is a major golf tour.

What reassurances have there been?

When the announcement was made regarding a scaling back of overseas investment in October, Telegraph Sport spoke to sources with knowledge of PIF’s inner workings and were immediately told that nothing had changed in its interest in nor ambition for Newcastle.

It was explained that as an existing project, there was nothing to fear regarding potential cuts, as this shift in strategy was more to do with new investments, not current ones.

Newcastle is a relatively small piece of PIF’s global portfolio and the sums of money spent are dwarfed by its other projects. The money being spent each season is easily sustained.

It was also pointed out that while the proportion of foreign investment from PIF will go down, it is also likely to increase in pure money terms, as PIF intends to spend more, not less, every year.

The Saudis have always made clear that Newcastle is a long-term investment and, privately, even in the early days after the takeover, they insisted this would not be like Manchester City and Chelsea before them. This is largely because of the fact the new rules put in place by the Premier League and Uefa prevent wealthy owners pumping vast sums of money in to pay for transfers and wages and achieve rapid success. This was known at the time of the takeover.

However, there have been some rumblings of frustration on Tyneside at the lack of progress being made in terms of boosting the club’s revenue streams through sponsorship deals linked to Saudi Arabia and PIF.

Newcastle’s front-of-shirt sponsor, Sela, is a PIF-associated company and the deal is worth around £25 million. That is a huge boost on the estimated £8 million a year Fun88 brought in when the takeover went through three years ago, but is still considerably less than the “Big Six” clubs receive.

However, Newcastle have been determined to stick to the Premier League’s rules regarding related-party sponsorship deals and as one insider told Telegraph Sport, if anything the owners have been too diligent in doing so. They have not been willing to challenge the rules in the same way as Manchester City and have not taken any sort of legal action to try to force a change for their benefit.

PIF does not want any negative publicity, which is why it also demanded the board sold players last summer in order to prevent a PSR breach.

In reality, Newcastle are not a top priority for PIF, even in terms of its sporting interests, with LIV a more headline-grabbing venture as well as boxing and staging the football World Cup, as they are capable of yielding a more instantaneous sense of gratification for its ambitions.

Newcastle chairman Yasir Al-Rumayyan is the governor of PIF and a key figure in the court of Mohammed bin Salman, the de facto ruler of the kingdom. He is also a keen golfer – some say in the obsessional category – and no matter how great an opportunity professional golf offers in geopolitical and financial terms, he has no doubt been drawn by his love of the sport and his desire to be among its top players, at least figuratively.

Al-Rumayyan is also the LIV chairman and regularly attends events and participates in the pro-am, where he has told the players “this is my baby”. LIV Golf unanimously refers to him as “H E” – His Excellency – and there seems almost a cult-like worship in the league. Perhaps, this apparent unconditional faith was necessary in the wake of the shock “framework alliance” between the PIF and the PGA Tour and DP World Tour in June 2023.

Many outsiders believed the mooted merger was LIV’s death knell. Sawgrass HQ would give Al-Rumayyan a place at the top table, allow the Saudis a sizeable berth in the branding and he would agree to kill off his pride and joy. But that was summarily rejected by his LIV subjects.

“I talked to H E last week,” Ian Poulter told Telegraph Sport in October 2023. “H E told me, never mind 2024, 2025 – LIV will go on and on.”

Since then Al-Rumayyan has continued to put the PIF money where his mouth is, signing up Jon Rahm on the biggest deal yet (in the region of £400 million), adding others such as Tyrrell Hatton to the roster and appointing several executives to notable positions. Multi-year contracts have been signed with sponsors and with courses and, in some cases, countries.

As the negotiations between PIF and the Tours have rumbled on – and on occasion, apparently stopped dead – so Al-Rumayyan has doubled down. Call it his pet project, if you will. But be assured it is a gorilla that would take some euthanising.

The big issues: What to address and why?

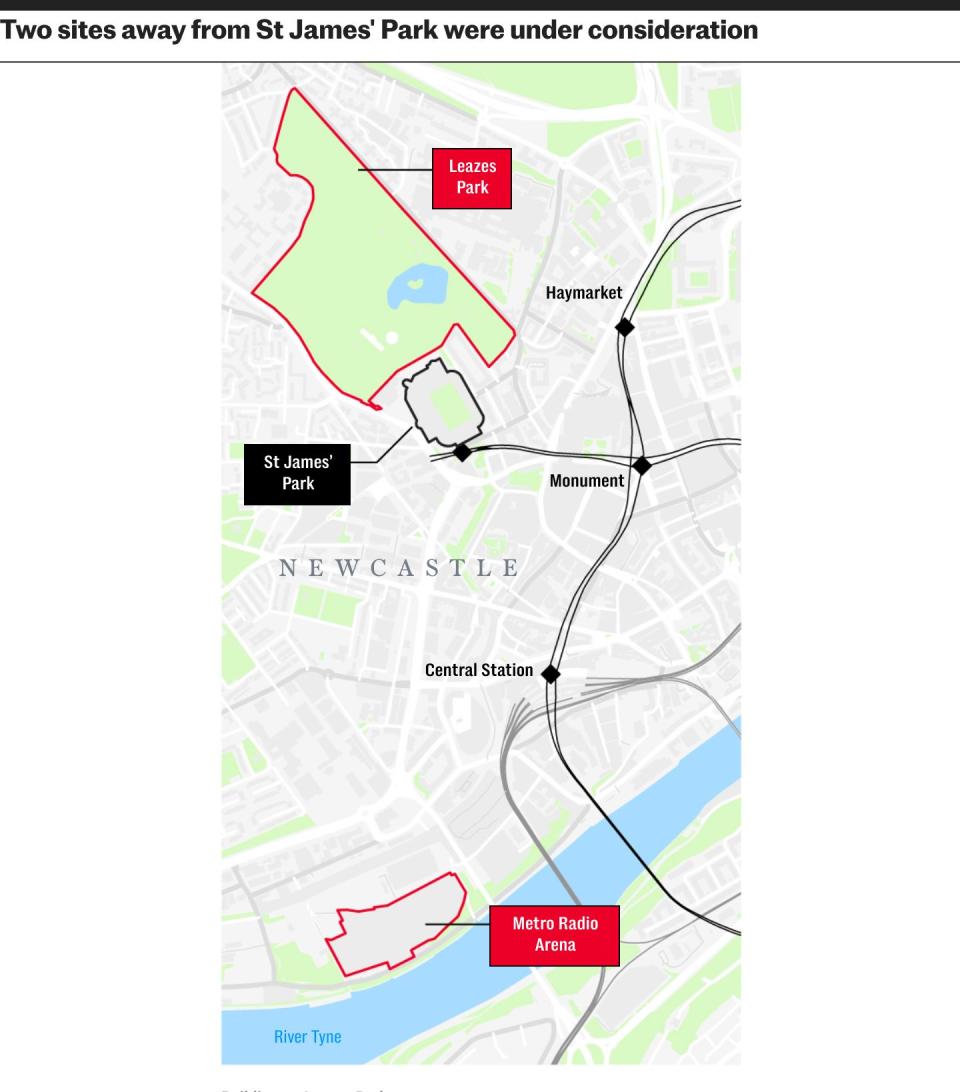

The acid test for PIF’s vision and ambition in Newcastle is the new stadium project. Telegraph Sport revealed last month that discussions have focused on building an entirely new stadium, either on the current St James’ Park site or on nearby Leazes Park. A capacity of more than 65,000 is thought to be possible and a feasibility study has been carried out.

Discussions continue but, crucially, when asked directly, Newcastle City Council revealed it had not yet been consulted about either plan.

In truth, the project has dragged on for too long and a statement released in October, which amounted to “no decision has been made and all options remain on the table” – meant the holding pattern that had existed for months was maintained. It felt like a can being kicked down the road.

Sources at the club had previously spoken about a reluctance from PIF to commit to spending the money to build a new stadium. Reassurances have since been offered to Telegraph Sport that this is not the case, with the explanation that PIF is a process-orientated organisation and it has to make sure what it promises is deliverable, cost effective and that the fund will see a return on its investment.

A cost of between £800 million and £1 billion has been mooted if Newcastle decide to rebuild and expand their current home, with the cost of an entirely new stadium on Leazes Park closer to £2 billion. It would also be at risk of all sorts of planning and legal challenges given Leazes Park is a Victorian-era green space and part of a wider conservation area. Neither option is simple or cheap.

But if Newcastle are going to compete with the richest clubs in England and eventually Europe, they need a modern, state-of-the-art, multi-purpose stadium that will boost revenue streams and help them with their current PSR constraints. They have seen rival football ground earnings soar not through football ticket sales, but by selling out lucrative concerts for the likes of Taylor Swift, Beyonce and Bruce Springsteen.

Frustrating lack of progress

Until we see the plans and eventually spades in the ground, the lack of progress is frustrating. A fresh announcement has been promised for early in 2025 but if PIF is serious about turning Newcastle into one of the best clubs in Europe, this project is imperative to that.

Fans are also awaiting news of a new training ground, but this has gone very quiet. There is a suggestion from those close to PIF that the new stadium and training ground schemes will be announced in one package sometime next year but this has not been confirmed.

We are also eagerly awaiting an announcement on the golf side of the equation, where the ongoing negotiations are everything and not just for LIV and its future – but for the entire landscape of the professional male sport.

Progress has apparently been made and there have been reports that with an initial £1.2 billion investment, PIF will take an 11 to 12 per cent share of PGA Tour Enterprises – the recently-formed commercial arm that also features the Strategic Sports Group, a US conglomerate spearheaded by the owners of Liverpool FC with its own £1.2 billion injection. In truth, this will be the easy bit.

The detail is bedevilled by what might happen next. Will LIV come under the tour umbrellas and will the rebels be welcomed back on the circuit with an amnesty, with no sanctions, no payback?

Will there be free movement between the tours and LIV and is it possible that in such a condensed market with a finite number of stars, weeks and eyeballs, that the game can flourish in peacetime? And all that, of course, is dependent on the US Department of Justice giving any truce the go-ahead on anti-competition rules.

The re-election of President Trump has been viewed as a boon in this respect, with Trump having already met with PGA Tour commissioner Jay Monahan and with Al-Rumayyan. Trump would love to be the character who fixed golf and it should be remembered that his family has a vast portfolio of quality golf courses, including Trump Turnberry and Trump Doral. Except, even if Trump inspires the DOJ to rubber-stamp a deal, questions will remain.

Will LIV scale back?

Will Al-Rumayyan be prepared to weaken LIV to have his piece of the overall pie and does that mean that LIV will make no more signings and allow contracts to run down? Barring the fact that there has been an absence of rumours around new additions so far in the LIV off-season, there is nothing else to suggest that LIV will begin scaling back.

Actually, it is anything but. The LIV-appointed head-hunting team has found a new chief executive, with Greg Norman moving upstairs, in American Scott O’Neil, the outgoing CEO of Merlin Entertainments, the world’s second-largest visitor attraction operator that controls Legoland, Madame Tussauds and Alton Towers. That was always the plan anyway with the Australian’s contract due to run out in August, at the end of the 2025 campaign.

The job of Norman, the great disruptor, is largely done and LIV requires a big business brain at the tiller. But what O’Neil will be in charge of specifically remains a mystery and, as with the rest of the game, it is the uncertainty that remains its most glaring weakness. LIV needs a plan and whether that is in unison with the PGA Tour and DP World Tour, or just with the DP World Tour, or even on its own, the project surely requires clarity in the forthcoming months.

Where the big changes and cuts will come

Notable LIV player contracts will start expiring next year and it will be intriguing to discover if it ponies up similar bounties as before. The word is that any up-front payments will be vastly reduced and if this is the case will heavyweights such as Brooks Koepka, Dustin Johnson and Sergio Garcia hang around?

The 14 captains have equity in their own teams, but that equity is not showing anything like a return at this juncture and, without a meaningful TV contract, it must be wondered from where the value will emerge. LIV is desperately trying to sign up with a big network – Fox and TNT have been mentioned – and if the league is to survive and flourish as a stand-alone operation then surely such a partner is vital.

LIV is not in a position to lower purses and maintain a strong arm around the negotiating table as it has to portray itself as ever expanding. If and when peace is reached then there will have to be a reckoning in any new order. The prize money is unsustainable if a future is to be forged in which the sport pays for itself. At the moment, however, that feasible, imperishable nirvana seems a long way in the distance and to arrive there concessions will have to be made by all parties – not just LIV.

PIF also insists nothing has changed in terms of its vision or ambition for Newcastle. It is, as one source put it, “business as usual” and there is nothing for supporters to be worried about by the reduction of overseas investment in favour of domestic projects. Talk, though, is cheap and there is no doubt progress in terms of boosting revenue streams has been slower than anticipated.

The lack of new sponsorship deals is a concern, especially given the way Manchester City have turned themselves into one of the richest clubs in the country through sponsorship deals agreed with companies linked to Abu Dhabi.

Saudi Arabia has not been willing to do the same, partly because of the new rules drawn up by the Premier League in the immediate aftermath of the Newcastle takeover in 2021.

But questions have been asked as to why more progress has not been made in this area. A training ground sponsor, training kit sponsor and stadium naming rights are just three of the lucrative areas Newcastle have not benefited from in the three years since the takeover. Newcastle are still a long way behind the ‘Big Six’ clubs in terms of revenue and are hamstrung as a result, especially in terms of player recruitment.

They are severely hampered in a PSR world and there is a fear they will need to sell one of their best players in the summer in order to fund future spending. That will have a detrimental effect on manager Eddie Howe’s efforts to compete for silverware and a Champions League place.

As things stand, Newcastle have probably established themselves as a top-eight club, which given all they aspired to under former owner Mike Ashley was Premier League survival, is a huge improvement. But they are a long way off being a Champions League one and have probably hit their ceiling in the short to medium-term.

Richer clubs can offer bigger transfer fees and wages, which gives them a huge advantage in player recruitment. It also makes Newcastle vulnerable in terms of fighting to keep their big-name players moving forward.

Several of their elite group have been unsettled this season and Howe has had a tough job to keep them focused and motivated when they know they can earn more money elsewhere and have a better chance of playing in the Champions League every season.

Having the richest owners in the world has proven to be largely irrelevant, so far, as they are simply unable to pump money into the club to speed up progress on and off the pitch. PIF said it wanted to turn Newcastle into the No 1 club in the country, but does not really seem to know how it is going to do that or how long it will take.

It is difficult to escape from the notion that PIF has a seat at the Premier League table and that is enough to satisfy it. And with other, more headline grabbing sporting ventures to consider, Newcastle is a relatively small and inconsequential part of their portfolio.

The new stadium can change that perception but the rules were drawn up to stop PIF turning Newcastle into another Chelsea or Manchester City and that collision between expectation and reality has been a sobering one.