Chewy (NYSE:CHWY) is Utilizing Shareholder Capital Efficiently, but Here is Why Some Investors are Worried About Growth

This article was originally published on Simply Wall St News

Chewy's (NYSE:CHWY) recent drop can make shareholders nervous since the stock declined 14% after the recent earnings report. We are going to see if the fundamentals justify the drop, and look at how efficiently is the company utilizing shareholder capital.

The company reported a solid second quarter result with reduced losses, improved revenues and improved control over expenses.

Some second quarter 2022 highlights:

Revenue: US$2.16b (up 27% from 2Q 2021), driven by a 21% increase in active customers, and a 13% increase in net sales per active customer.

Net loss: US$16.7m (loss narrowed 49% from 2Q 2021)

Management interprets these results as:

"Customer engagement is growing, and we are confident in our ability to deliver strong results while navigating uncertain market conditions due to the ever-evolving COVID-19 pandemic."

When a company is doing great, they usually make a point to highlight both customer growth and the spend per customer. Chewy did not mention active user growth, which leaves us wondering where will future growth come from. Also, the mention of the pandemic in the end of the statement, is quite confusing, because the company benefited financially from the pandemic, and it is strange to see it mentioned as a risk. Perhaps some investors, which sold stock, interpreted this as a primer for future bad news.

See our latest analysis for Chewy

Measuring Returns

It seems the company's revenue growth rate will probably decline from its historical 37% rates, and analysts estimate that the company will continue to grow revenues at a stable 18.3%. This may reduce the future valuation of the company, because analysts in the past were a bit more generous with the growth rate estimates.

Our analysis will focus on how efficiently is Chewy re-investing shareholder capital. In the last 12 months, the company has raised over US$226m in cash from financing activities (such as issuing additional shares), and it is great to know what is the expected return on these investments.

For that purpose, we will use Return on Equity as our primary measure.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors' money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Chewy

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Chewy is:

14% = US$10m ÷ US$75m (Based on the trailing twelve months to August 2021).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each $1 of shareholders' capital it has, the company made $0.14 in profit.

A Side By Side comparison of Chewy's Earnings Growth And 14% ROE

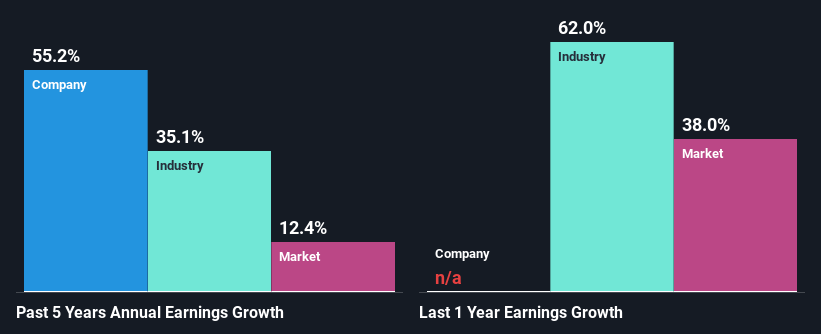

At first glance, Chewy seems to have a decent ROE. Yet, the fact that the company's ROE is lower than the industry average of 20% does temper our expectations. Still, we can see that Chewy has seen a remarkable net income growth of 55% over the past five years. However, not to forget, the company does have a decent ROE to begin with, just that it is lower than the industry average.

We then compared Chewy's net income growth with the industry, and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 35% in the same period.

Since Chewy is still in a high-growth phase, and currently attempting to solidify its market share, it is expected to have higher growth rates than the market, but a great sign nonetheless.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Chewy's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Conclusion

In total, we are pretty happy with Chewy's performance thus far. It seems to be delivering growth at an acceptable return on equity of 14%. Which is a great position for the company.

The downside is that this growth may not be sustainable, and investors might have concerns over the future performance and its impact on the valuation of the company.

When thinking of the future of Chewy, we can ask ourselves a few questions:

Will people adopt more pets in the future?

Will people seek to provide better care for their pets?

Are most pet owners already aware of Chewy?

When we can't quit interpret the financials, it is great to see what management really thinks of the company and not just what they say in press releases. That is why this list of insider transactions is particularly valuable to investors.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Sport

Yahoo Sport