As Cyber-Security Gains in Importance, Cloudflare, Inc. (NYSE:NET) is Attracting Institutional Interest

This article first appeared on Simply Wall St News.

After an uneventful start of the year, Cloudflare, Inc. ( NYSE:NET ) proved to be one of the biggest tech winners, rising as high as 70% year-to-date.

Yet, it doesn't come as a surprise, as cyber security gains the interest of both the private and public sectors. This article will examine the latest developments and look into the current shareholder structure.

Latest News

Cloudflare has priced US$1.125b in convertible senior unsecured notes, due August 15, 2026. While this is an increase from the original US$1b planned, the notes remain without cash interest on the principal, essentially yielding 0%. However, since they are convertible, they offer an option to convert into stock under the specified circumstances.

Meanwhile, Check Point's mid-year security report estimates that there were 93% more ransomware attacks in the first half of 2021 than in the first half of 2020. According to an IBM estimate, data breaches now cost US$4.24m per incident.

President Joe Biden summoned chief executives of the largest tech companies, urging them to step up and meet the increasing threat of cyber security. Biden reflected on the fact that the majority of the critical infrastructure is now within the private sector, hinting that the cyber security sector might get regulatory tailwinds in the face of the rising threats.

In the latest infrastructure update, Cloudflare announced they would be using AMD EPYC Milan CPUs. While Intel ( NASDAQ:INTC ) was able to compete when it comes to performance, the company quoted AMD ( NASDAQ:AMD ) as a more efficient solution.

See our latest analysis for Cloudflare.

Examining the Ownership

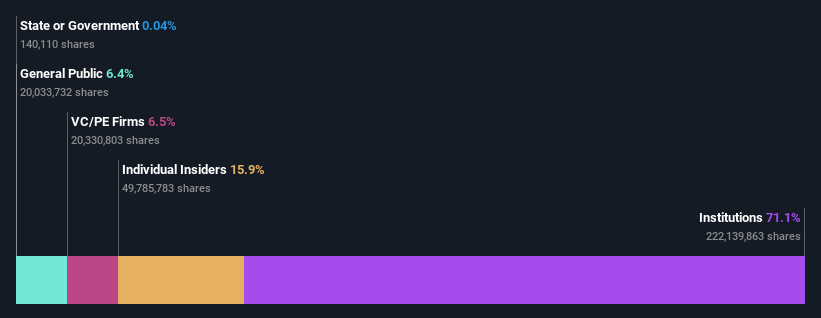

With a market capitalization of US$41b, Cloudflare is rather large. We'd expect to see institutional investors on the register. Companies of this size are usually well known to retail investors, too.Looking at our data on the ownership groups (below), it seems that institutions are noticeable on the share registry.We can zoom in on the different ownership groups to learn more about Cloudflare.

What Does The Institutional Ownership Tell Us About Cloudflare?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

We can see that Cloudflare has institutional investors, and they hold a good portion of its stock.This implies the analysts working for those institutions have looked at the stock, and they like it.

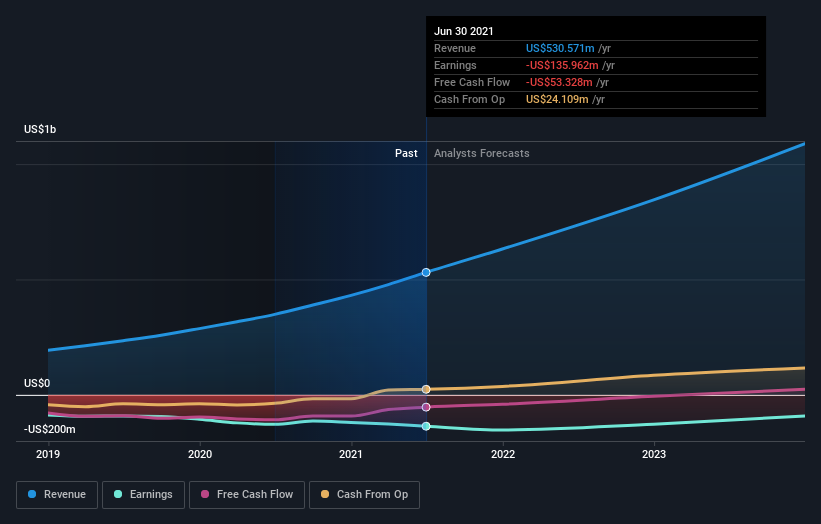

However, it can be a crowded position, and it is not uncommon to see a big share price drop if two large institutional investors try to sell out of stock simultaneously. So it is worth checking the past earnings trajectory of Cloudflare (below). Of course, keep in mind that there are other factors to consider, too.

Institutional investors own over 50% of the company, so together, they can probably strongly influence board decisions.Cloudflare is not owned by hedge funds.

With an 11% stake, CEO Matthew Prince is the largest shareholder.The second and third largest shareholders are FMR LLC and Baillie Gifford & Co., with equal shares to their name at 9.7%. Among the most known institutional names, The Vanguard Group has a 6.52% stake, while BlackRock has 4.69%.

On further inspection, we found that more than half the company's shares are owned by the top 6 shareholders, suggesting that the interests of the larger shareholders are balanced out to an extent by the smaller ones.

Insider Ownership Of Cloudflare

The definition of company insiders can be subjective and does vary between jurisdictions. Our data reflects individual insiders, capturing board members at the very least.The company management answer to the board, and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

Our most recent data indicates that insiders own a reasonable proportion of Cloudflare, Inc.It is exciting to see that insiders have a meaningful US$6.5b stake in this US$41b business.Most would be pleased to see the board is investing alongside them.

You may wish to access this free chart showing recent trading by insiders.

General Public Ownership

The general public doesn't have a strong presence, holding just 6.4%.We'd generally expect to see a higher level of ownership by the general public than this. It's not too concerning, but it is worth noting that retail investors might struggle to influence board decisions.

Private Equity Ownership

Private equity firms hold a 6.5% stake in Cloudflare. This suggests they can be influential in key policy decisions.Some might like this because private equity are sometimes activists who hold management accountable. But other times, private equity is selling out, having taken the company public.

Further Reading:

While it is well worth considering the different groups that own a company, other factors are even more important. For instance, we've identified 3 warning signs for Cloudflare that you should be aware of.

But ultimately, it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to look at this free report showing whether analysts are predicting a brighter future .

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Sport

Yahoo Sport