E-mini Dow Jones Industrial Average (YM) Futures Technical Analysis – Reaction to 27729 – 28040 Sets the Tone

December E-mini Dow Jones Industrial Average futures are expected to open higher on Monday as investors cheered what appeared to be improvements in President Donald Trump’s health and the prospect that he may be discharged from Walter Reed hospital later in the session.

White House chief of staff Mark Meadows told NBC News Monday that, “The discharge decision will be made later today between the president and his medical team.”

At 13:27 GMT, December E-mini Dow Industrial Average futures are trading 27753, up 188 or +0.68%.

Trump’s illness, as well as a weak September jobs report, highlighted the urgency for further coronavirus stimulus after a months-long stalemate in Washington. Optimism for reaching a compromise rose over the weekend after House Speaker Nancy Pelosi signaled progress on Friday, saying “we continue to work on the text to move more quickly to facilitate an agreement.”

Daily Swing Chart Technical Analysis

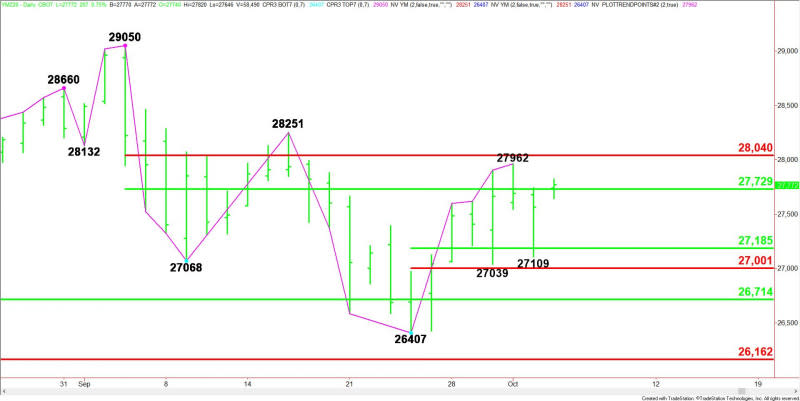

The main trend is down according to the daily swing chart. However, momentum is trending higher. A trade through 28251 will change the main trend to up. A move through 26407 will signal a resumption of the downtrend.

The minor trend is up. This is controlling the momentum. Taking out 27962 indicate the buying is getting stronger. The minor trend changes to down on a move through 27109. This will shift momentum to the downside.

The short-term range is 29050 to 26407. Its retracement zone at 27729 to 28040 is the primary upside target. This zone is currently being tested. It controls the near-term direction of the Dow.

The minor range is 26407 to 27962. Its retracement zone at 27185 to 27001 is support. The last two minor bottoms at 27109 and 27039 are inside this zone.

Daily Swing Chart Technical Forecast

Based on the early price action, the direction of the December E-mini Dow Jones Industrial Average on Monday is likely to be determined by trader reaction to the short-term 50% level at 27729.

Bullish Scenario

A sustained move over 27729 will indicate the presence of buyers. This could trigger a rally into the minor top at 27962 and the short-term Fibonacci level at 28040. Taking out 28040 could trigger a rally into the main top at 28251.

Bearish Scenario

A sustained move under 27729 will signal the presence of sellers. This is a potential trigger point for an acceleration to the downside with 27185 to 27001 the next potential downside target zone.

For a look at all of today’s economic events, check out our economic calendar.

This article was originally posted on FX Empire

More From FXEMPIRE:

USD/CAD Daily Forecast – Canadian Dollar Gains Ground On Strong Oil

GBP/USD Forecast – British Pound Continues to Test Same Resistance

Crude Oil Price Update – Testing First Retracement Zone Target at $39.48 – $40.08

U.S. Dollar Index (DX) Futures Technical Analysis – Minor Trend Turns Down as Risk Appetite Returns

Yahoo Sport

Yahoo Sport