Not Many Are Piling Into Wolfspeed, Inc. (NYSE:WOLF) Stock Yet As It Plummets 32%

Unfortunately for some shareholders, the Wolfspeed, Inc. (NYSE:WOLF) share price has dived 32% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 53% share price decline.

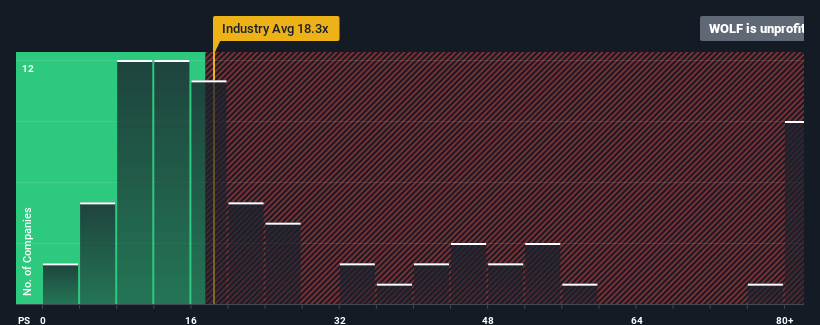

Even after such a large drop in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 15x, you may still consider Wolfspeed as a highly attractive investment with its -18x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been advantageous for Wolfspeed as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Wolfspeed

Want the full picture on analyst estimates for the company? Then our free report on Wolfspeed will help you uncover what's on the horizon.

Is There Any Growth For Wolfspeed?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Wolfspeed's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 31%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 13% during the coming year according to the analysts following the company. That's shaping up to be materially higher than the 5.0% growth forecast for the broader market.

With this information, we find it odd that Wolfspeed is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Wolfspeed's P/E?

Having almost fallen off a cliff, Wolfspeed's share price has pulled its P/E way down as well. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Wolfspeed currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Wolfspeed with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Sport

Yahoo Sport