SYF Resources Berhad's (KLSE:SYF) investors will be pleased with their splendid 163% return over the last three years

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But in contrast you can make much more than 100% if the company does well. For example, the SYF Resources Berhad (KLSE:SYF) share price has soared 155% in the last three years. That sort of return is as solid as granite. In the last week the share price is up 1.3%.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for SYF Resources Berhad

SYF Resources Berhad wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

SYF Resources Berhad actually saw its revenue drop by 27% per year over three years. So the share price gain of 37% per year is quite surprising. It's fair to say shareholders are definitely counting on a bright future.

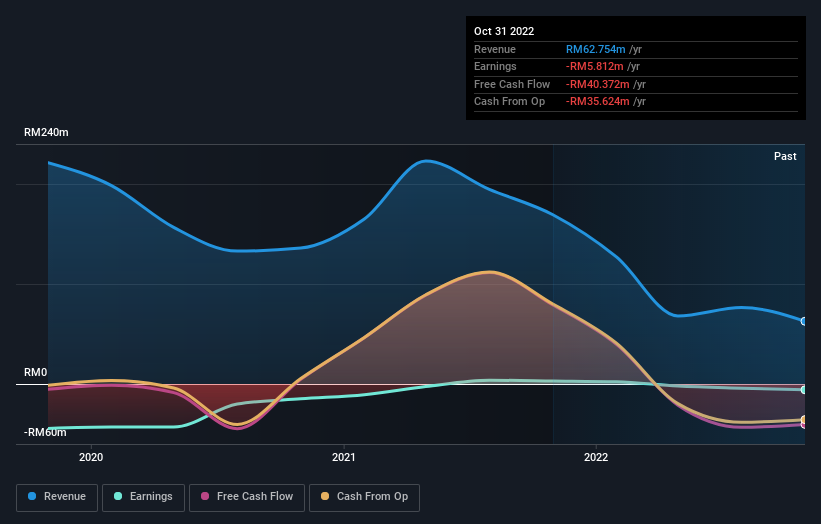

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

We've already covered SYF Resources Berhad's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for SYF Resources Berhad shareholders, and that cash payout contributed to why its TSR of 163%, over the last 3 years, is better than the share price return.

A Different Perspective

It's nice to see that SYF Resources Berhad shareholders have received a total shareholder return of 39% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 7% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand SYF Resources Berhad better, we need to consider many other factors. Take risks, for example - SYF Resources Berhad has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Sport

Yahoo Sport